Chasing Shadows: the CBN cannot live with its failures

Historical perspective on the parallel market exchange rate in Nigeria

In the past few months, the CBN has attacked BDCs and commercial banks for manipulating the exchange rate. I do not pity them.

If policymakers are not attacking these institutions, it would be Nigerians who they say have a high appetite for foreign made goods. Many Nigerians believe this too, but while we can tolerate them (including professors on LinkedIn talking trash), let’s pretend to hold the CBN to a higher standard.

People still look forward to the MPC meeting?

Yesterday, I saw WhatsApp updates of Emefiele inviting AbokiFX’s founder and his supporters to a shouting, or maybe its a fist match. That is not a big deal because Emefiele cannot buy class. We went from Soludo and Sanusi to someone with the composure of a tout.

The updates were from analysts in Nigeria. That should not be surprising because unless you are paid to listen to Emefiele, you really should not. He is unremarkable. But we can’t all be paid to listen to him. I stopped listening to the MPC meeting a while back. The MPC meeting is a bi-monthly ritual without significance.

The CBN claims AbokiFX is manipulating exchange rates. We were always going to get here, so, again, no surprises. One of CBN’s mandate is exchange rate stability. This is probably why Emefiele’s self-esteem is tied to this. When the exchange rate is unstable, the CBN looks for scapegoats. The CBN cannot live with its own failures.

We have been here before, just five years ago, and 4 decades before. In Nigeria, history does not rhyme, it repeats itself in pristine form.

There is no liquidity and price discovery in the FX Market

The Nigerian FX market is broken. In the official segment or the market for investors and exporters (I&E FX window), there is no price discovery. The exchange rate does not respond to changing macroeconomic conditions that should affect pricing. This is not because the CBN has enough firepower to support the stable rate. Historical data show that the CBN’s FX supply to that segment is weak and yet to recover to the pre COVID-19 peak levels.

“price discovery is concerned with finding the equilibrium price that facilitates the greatest liquidity for that asset”

The issue is that when prices are not allowed to change, there will be no liquidity. The CBN tightly controls the I&E FX window. And because of that investors and exporters stopped bringing money into the country - no liquidity! Recall that the CBN has also attacked exporters.

When there is no liquidity, prices will not move. The stock exchange is where we can see this clearly. Some stock prices do not move, even though prices are allowed to change. For prices to move, a predetermined volume must be traded. In the extreme case, if there are no sellers or buyers, price will not change. And if there are buyers and sellers but they are not doing the required volumes, price will be static.

Transactions in the market place happen when buyers and sellers agree on a price. The parallel market is the only segment close to a free market, so obviously that is where you can see exchange rate that responds to macroeconomic conditions.

The parallel market is fragmented. This includes the BDCs and many other small players and individuals scattered all over the country in markets, under trees, and everywhere with cover from sunlight. This is what makes it hard to track rates, but this will also make it hard to manipulate rates.

Is AbokiFX really manipulating the exchange rate?

It is ridiculous that we are having the conversation but we have to because many people believe that AbokiFX manipulates rates. I do not think this is the truth, at least to the extent that it would be significant and persist for the long-term. I will explain.

What AbokiFX does is to aggregate rates in Lagos. AbokiFX is not the only institution collecting the data, nor are they the only ones publishing it. But they have a good product and it’s super convenient, so it is the most popular.

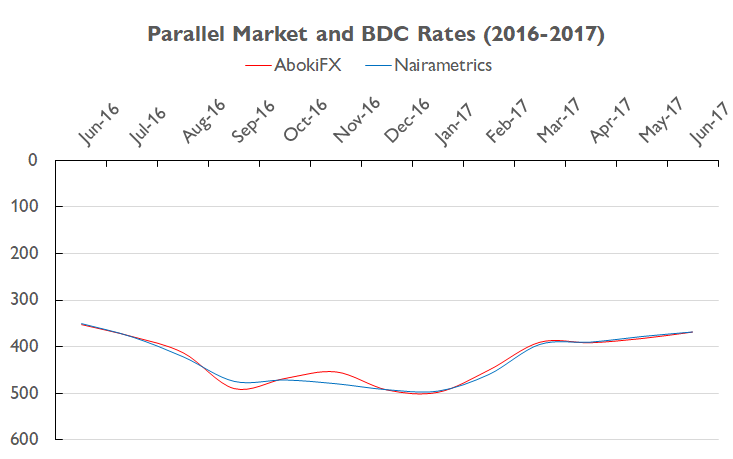

Guess who else publishes parallel market rates? Nairametrics. AbokiFX started publishing in 2014, Nairametrics started collecting its own independent parallel market data in mid 2016 at the peak of the currency crisis. The CBN collects data from the BDCs, and these rates are also reflective of what is happening in the parallel market. So let’s consider all three.

It is clear that these rates deviate from each other. But what is obvious is that majority of the time, they track each other and differences are quickly corrected.

From 2014-2015, the average deviation was N4.57/$. Nairametrics was not in the market then, so that was a comparison of CBN’s published BDC rates vs AbokiFX’s. Nairametrics emerged in June 2016, so let’s have a clearer view of how their parallel market rate data compares with AbokiFX. The average deviation was N2.38/$. Both collect independent data that closely match and both companies have months where they have higher rates than each other, but this is never for a long time. That’s how a proper market works and why any single player will find it hard to manipulate rates.

If we go with my existing theory that AbokiFX is more popular, which should mean that they act as a signal to more people, can their manipulation really exist for long? Is there any manipulation when the data published by other outlets are not different? Let me relax my popularity assumption. The truth is Nairametrics is much bigger than AbokiFX in terms of website ranking. This makes sense because AbokiFX is strictly for rates while Nairametrics provides other services. However, for what it’s worth, the search for rates is popular among key words that lead people to Nairametrics.

Now to the present. How has parallel market data evolved since the beginning of the currency crisis in March 2020? I do not have Nairametrics data since then, I am not sure they still publish parallel market data. But looking at AbokiFX rates vs CBN reported BDC rates, there were large differences in March, April and November 2020, but these were quickly corrected. This is what happens in a free market. In some months, the BDC rates were even higher than AbokiFX rates. What is also noticeable is that parallel market rates tend to be leading rates. The CBN regulates BDCs so they are slow to adjust.

Another great thing that has happened recently is the crypto markets. You can always see how Naira trades in this market with respect to other currencies pegged to the USD. Is that manipulation too? In fact, the rates on these platform are sometimes leading rates. Obviously, regardless of what a currency is named, as long as they are pairs, if the demand of one is higher than the supply, one would depreciate. This is enough rebuttal for CBN’s claims.

Is it just me or why did the CBN not complain about manipulation when the I&E FX window, BDC and AbokiFX rates were roughly the same over the period between April 2017 and February 2020?

There’s no data to back up CBN's misguided claim of manipulation. If investors and other stakeholders have confidence in the CBN, AbokiFX would not be in business. The website won’t be patronised from all over the world. It is in Nigeria that dumb FX policies consistently create extraordinary returns on economic activities that should not command a premium.

The CBN is chasing shadows. It is important that people realise this and focus on the CBN’s failures rather than obsess over institutions that they have been convinced to think are destroying the currency.

End.

For those who want a more detailed read on Nigeria’s FX problems and the poor approach of the CBN, you can go through prior articles and my 2020 round up.

If you enjoyed this newsletter, please share and subscribe. Also feel free to leave comments for me.

Adedayo, you know I am paid to listen and track the MPC. If I say I like this article, I may risk a frozen account. So, I dislike your article. My Uncle at the leadership of the CBN is correct and I won’t give you a thumbs up. Perhaps, I will grow up to have your kind of nerves, one day. Until then, I will unfollow your network from today in solidarity.

Next MPC "That Adedayo or whoever and his supporters should come and fight me at my office".