Un Poco Loco: CBN's Currency Redesign

Why should Nigerians bear the cost for a policy that is unlikely to achieve anything?

I thought I could avoid writing about the redesign of bank notes in Nigeria but the quality of commentary makes me uneasy.

I am writing this blog to tackle some misconceptions around what a currency redesign can potentially achieve.

I intend to focus on the policy aspect as I noticed that people do not understand how money works. If you want a quick summary of my view on the policy, you can read my interview with Zikoko or with AP. If you want a more thorough, data backed analysis, read on.

The CBN in its announcement said the country is facing three main challenges for which a currency redesign is the solution.

These challenges are highlighted below:

“Significant hoarding of banknotes by members of the public, with statistics

showing that over 85 percent of currency in circulation are outside the

vaults of commercial banks. Evidently, currency in circulation has more than doubled since 2015; rising fromN1.46 trillion in December 2015 to N3.23 trillion in September 2022. This is a worrisome trend that cannot be allowed to

continue”“Worsening shortage of clean and fit banknotes with attendant negative perception of the CBN and increased risk to financial stability”;

“Increasing ease and risk of counterfeiting evidenced by several security reports.”

There is a long list of benefits the CBN expects and one can only conclude that they think of the currency redesign as a magic bullet.

Let us dispel some myths.

#1 Redesigning bank notes is normal procedure and should be painless

Countries redesign currencies for various reasons, which could range from trying to improve the quality and security features to reflecting the face of a new monarch, like we will see in the UK in the coming years.

In Nigeria, we designed a separate N100 note for our centenary celebrations in 2014. Four years prior in 2010, we designed N50 notes to mark our 50th independence anniversary. The old and new notes were valid for transactions.

Redesigning a currency should be that simple. But we do not do simple things. If the purpose of the currency redesign is to fight counterfeiting, it can be implemented over a longer period and not cause the public unnecessary pain. If the worry is about the shortage of “clean and unfit notes”, the CBN can collaborate with banks to ensure smooth printing and distribution of new notes.

#2 The public’s holding of bank notes does not mean it is being hoarded and the level of cash in circulation is not unusual

Bank notes are meant to be held outside the banking system for all the purposes that money satisfies, that’s the entire point of having the notes. Otherwise, why print the notes? The CBN claims that having 85% of total bank notes issued in the hands of the public “is a worrisome trend that cannot be allowed to continue” but this is nothing unusual.

Historically, Nigeria has always had around more than 80% of currency in circulation outside the banking system. If there is a wide gap between what the public is holding and what banks have in their vaults, there will be less demand by banks for notes and the CBN will print less of it over time.

The level of cash in circulation is also low relative to our GDP and total money supply, compared to peers and even advanced economies. This is a great measure of physical cash penetration, after all, money is spent on output.

It should also not be surprising that the level of currency outside banks doubled between 2015 and 2021 - it just means more people decided to hold notes rather than leave it in bank vaults. The CBN has already printed the notes in anticipation of demand.

The fact that cash in circulation has not doubled when total money supply in the economy has more than doubled means we are not using as much cash. The CBN is responsible for controlling money supply and it has done a terrible job over the past 7 years.

Currency in circulation relative to total money supply is much lower - it was 8.6% in 2015 but fell to 7.5% in 2021.

#3 Holding more of higher value bank notes is completely normal due to high and persistent inflation

The CBN finds it troubling that most of the cash in circulation are higher value notes like N200, N500, and N1,000. With high and persistent inflation, this should not be surprising because no one wants the burden of carrying around lower denomination notes.

In terms of buying power, N200 today was worth N40 in 2010, N500 today was N102 and N1,000 today was only worth N204.

Another way it can be interpreted is that you need N977 today to buy what was worth N200 in 2010, N2,444 to buy what was worth N500 and N4,888 to buy what was worth N1,000.

Why is this hard to understand? This is also not unique to Nigeria. In the UK, Ghana and SA, higher value bank notes are held.

In fact, the data suggests that the CBN should introduce more higher value notes. It is a consequence of the institution’s failure to meet its primary goal of stable and low inflation.

#4 Counterfeiting is not as big a problem as the CBN is portraying it

How big of a problem is counterfeiting? Not so much. The ideal outcome is to have zero counterfeiting but that is impossible. Counterfeit notes started circulating in India in less than 60 days after demonetisation.

What we should aspire to is to keep counterfeiting below the standard threshold (in comparison with other countries) and ensure that the trend is not worrisome.

We currently do well on both parameters.

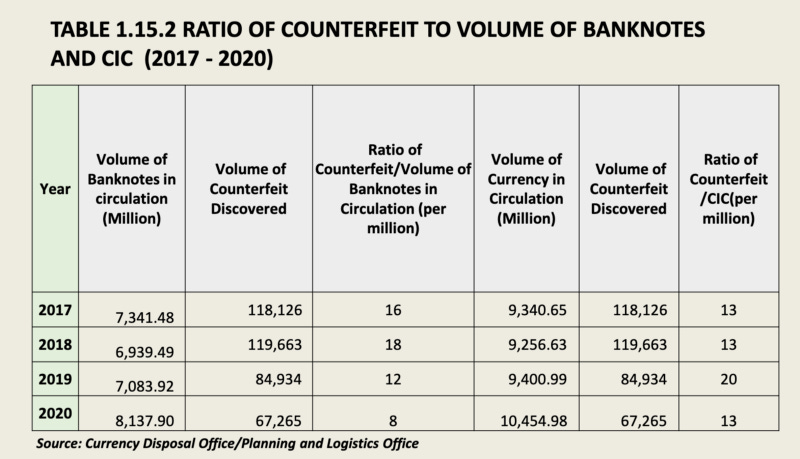

In Nigeria, counterfeiting was 13 pieces per million bank notes in 2020 (could be much lower as it’s based on wrong calculation by the CBN), down from 20 pieces per million bank notes in 2019. The total value of counterfeit notes in 2020 was N56.8m, down from N64.7m in 2021. This is not significant when we have over N3.2tn notes in circulation.

We even do better than some advanced countries. Based on the Bank of England data, counterfeiting was as high as 44 per million in 2020 before dropping to 24 per million in 2021.

Is it just me or the ratios in the last column of this table for 2019 and 2020 are poorly calculated?

It’s either our bank notes are secure or maybe the counterfeiting of worthless notes is not worth the effort.

#5 A currency redesign will not solve insecurity and money laundering problems

Well, why are we not redesigning the currency every other year? After all, the cost of printing, disposing of old currency and distributing new currency is much less than the costs of insecurity on the economy.

Perhaps, an argument can be made that if there is the scarcity of cash, like we are witnessing currently, it would be harder to pay ransoms in cash. But this is only a temporary problem. Humans are creative and notes will eventually circulate.

There is also a much higher level of sophistication required within the financial system to fight money laundering.

New notes, old notes, still the same money laundering and insecurity problem over time.

#6 A currency redesign will not solve our inflation problems

This is a topic I care much about. We have a devastating inflation problem in Nigeria but the CBN does not care about it. The last time the CBN’s target (6–9%) on inflation was met was in 2014. In January 2023, Nigeria’s inflation rate was 21.8%. Considering that Godwin Emefiele resumed mid 2014, one can say he has never achieved the CBN’s inflation target independently.

And if you can’t meet your primary goal, what would you do? Ignore. The CBN pretends not to notice and barely mentions its inflation target again. Even worse, the monetary policies implemented are at odds with what a Central Bank fighting inflation would do.

You can then imagine how hilarious it is that anyone would take the suggestion that a currency redesign would solve inflation seriously.

Of course, if you take away bank notes in a country where a lot of people rely on cash to spend, it could slow down the rate of price increases in the very short-term. And that is if one further assumes that a significant share of transactions is done in cash and people are unable to switch to other means of payment. But that would make no sense because it would damage the economy.

To curb inflation, one thing the CBN can do is to slow down the pace of growth in money supply given the long-term relationship between both. And unlike most people think, money supply is not just currency outside banks. It includes current account, savings account and other near cash (money market funds etc) balances. Currency outside banks, which the CBN was worried about, is only 6.6% of total money supply. Think about it — what do you spend when paying with bank transfers and debit cards?

To suggest that redesigning 6.6% of money supply - which is not going to be destroyed but converted to bank deposits (excluding those that don’t make it to the bank) to be later spent - is the solution to inflation is insane.

This is the same CBN that has recklessly loaned over N22tn to the FG in less than 5 years and continues to pump money into the economy with all sorts of poorly designed and implemented intervention schemes. This is the same CBN that does not meet its own money supply growth targets.

Even worse, I watched an interview where Godwin Emefiele claimed that N2.7tn out of the N3.2tn in circulation is hidden in people’s homes and unavailable for economic transactions. This is pure nonsense.

Surely, if the cash is not being used for transactions you should not be worried about the inflation impact. Also, there is nothing wrong with keeping money at home — it is my choice to save at home than at the bank. Money, whether under pillows or in a bank account, serves as a store of value. Bank notes can be used for that purpose, not only financial system deposits. In fact, with the recent hardship associated with accessing cash, it makes sense.

Implementation/Post-Deadline Review of Currency Redesign

It was easy to know that this redesign would be a disaster. The timeline was simply too short and the CBN failed at making available new notes in time.

Here are seven other things I have noticed.

#1 Cash is king, yet poorly understood

In my interview with Zikoko, I talked about the importance of cash. The only reason CBN prints bank notes is because people need it for transactions and for all the utility it offers — that’s why the majority will always be outside banks. Offering bank notes is so expensive, delicate and complicated that no one would want to do it if it’s not necessary.

In the following paragraphs, I share some quotes from the interview.

On why the CBN issues cash: “Cash is the liability of a central bank because they’re the ones who issue it. Now, when the CBN issues cash, it doesn’t do so out of thin air. It prints it because people need it for transactions. When people need cash, they go to the commercial banks.”

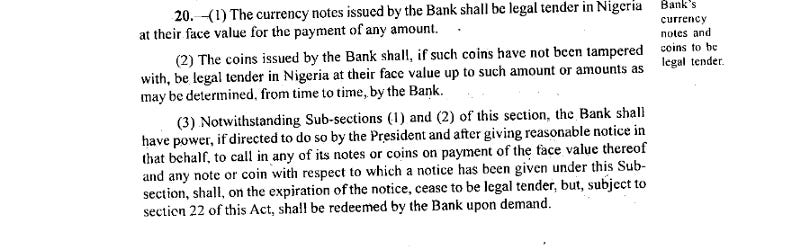

This is why the CBN is mandated by its act to redeem bank notes (check CBN Act, 2007), even if it is no longer a legal tender, as long as it’s not damaged.

How people get access to cash: “When customers request cash, it becomes the responsibility of the banks to get it from the CBN. What this means is that the excess of cash in circulation isn’t just because the CBN wants to put cash out there, it’s because people are demanding it. The CBN therefore has to print it.

The banks can also redeem the notes they have with the CBN for reserves at any point in time.

Why cash is the most inclusive form of payment:“When you look at the purpose of cash itself, it’s the most inclusive payment system we have in the country. For me to use my bank app, I need to have access to the internet. To use USSD, I need to have access to mobile phones. For internet banking I need to have a smartphone. How many people have these? How many people have the education to use Paystack, Flutterwave, or any of the other payment systems?

“Cash also doesn’t rely on any third party. Once you have it, there’s complete autonomy to conduct transactions. True, holding it comes with its security risks and it loses value, but that’s people’s preference. Think about it, this new policy is saying the money you have in the bank you can’t do this with it, you can’t withdraw it all at once. If I’m holding cash, nobody can tell me that. Cash is also instant which is why people use it for settlement. There are cases where people get fraudulent alerts, which is why they resort to cash instead.”

On what happens when cash is not available: “You can’t say you want to restrict one of the primary ways people conduct transactions in your economy. This policy will only slow down transactions in the informal economy and affect the economy negatively in terms of output, job opportunities and what they can earn. It’s not a crime to hold money.”

#2 The CBN thought people would deposit old notes and not ask for new notes

Listening to the staff of the CBN on this issue has been revealing, demystifying any perception of great leadership and competence.

On November 24, Reuben Abati quoted me in an interview with the CBN’s Director of Currency Operations. It was an embarrassing watch for me. This Director was complaining that people had not been depositing old notes.

Why would people do that when new notes were to be released mid December and they still need cash for transactions? This showed how poor the CBN’s understanding of the role of cash is.

#3 The CBN does not want to replace the cash taken out

In addition to the point above, the CBN thought it could print only N200bn to replace over N2tn taken out of circulation. When even the CBN Governor thinks cash outside banks is hidden and not used for transactions, then the reasons are clear.

We all know the consequence of that — long queues, a slowdown in transactions and unnecessary pain.

#4 The Mint was unprepared for the redesign

Premium Times reported capacity constraints at the Mint has a key reason why the currency redesign is failing.

I believe that only tells part of the story. I suspect that the problem is that the CBN did not prepare the Mint on time for the redesign. I have a Twitter thread with explanation and data on this.

#5 Banks are scapegoats as is common with policy failures in Nigeria

Policymakers in Nigeria have mastered the art of misdirection. It is the CBN’s responsibility to ensure that new notes are printed in the required amounts that would make the process of withdrawal seamless. However, because banks interface with customers, people now believe that banks are sabotaging the policy. POS operators are also scapegoats for reacting to the realities the CBN imposed.

In the CBN’s propaganda arsenal are the ICPC and EFCC who have conducted raids and released some misleading videos to the public suggesting that banks are crippling policy implementation.

This is not new. Today it is about bank notes, but it was once about fuel and the exchange rate.

There was a time the EFCC and ICPC were also hired to arrest BDC executives and parallel market players in a bid to restore stability to the currency. Where are we on that today?

There was a time petrol stations were always raided for selling above regulated prices during periods of scarcity.

Anytime there is scarcity as a result of the failure of government institutions, there are always scapegoats. We should all know this already.

This is the CBN deliberately damaging trust in the banking system. We live in a low trust society when it comes to financial services and this only makes it worse.

#6 On the surge in electronic transactions

This is hardly a surprise. If there is a cash crunch, people will explore alternatives. It is not evidence that the policy is a success.

The adoption of electronic payments has grown rapidly in the past decade without this policy and will continue to even when everything settles. E-payments grew simply because solutions that make it convenient to pay digitally proliferated — that is how you reduce the dependence on cash without imposing huge costs on the public.

The idea that electronic payment or going cashless is some silver bullet to achieving economic prosperity and monetary policy effectiveness is exaggerated. The idea that cash must be zero for that to happen is unreasonable — it is why no sensible Central Bank has taken such a drastic action.

The CBN is looking to blame its failures on something almost totally unrelated to the effectiveness of its policies.

And here is something to remember: stupid policies create winners and losers. In Nigeria, the losers are usually in the majority. And that is how you know a bad policy.

Dumb policies make billionaires too, it still is dumb. Like cement producers. Like farmers planting rice. And many more.

#7 On the redemption of the currency

The CBN ACT (2007) is clear on redemption. In plain terms, even if bank notes cease to be legal tender as declared by the CBN, the institution must still redeem it as long as it isn’t lost or damaged.

And this is subject to the conditions here:

The deadline imposed by the CBN for redemption is illegal and unreasonable. The CBN saying that notes cannot be redeemed at the banks but instead at its offices is another way to cause more hardship.

If you enjoyed this newsletter, please share and subscribe. Also feel free to leave comments for me.

Absolutely enjoyed reading this piece, thank you for the insights.

However, I feel made points under misconception #5 is quite watery (also judging from the level of detail compared to other paragraphs). The truth is, regardless of whatever systems upgrade or sophistication implemented in the financial system, dubiously creative minds would always work around ways to game the system. Does it means efforts like this should not be made? No. Does it mean progressive attempts should not be made, even if it might fail? No.

This piece also failed captured any possibility of the CBN's policy being politically motivated or acting based on highly classified information to do the abnormal (hasty implementation). Could it be a matter of urgency; choosing between two evils, which has made this poor and hastily implementation the "necessary evil" in the short term, especially considering that Nigeria is currently in a very sensitive season?

I guess we'll never know (except for those who have the appropriate security clearance)

Brilliant piece Dayo, well done. I was the one who interviewed you in the Zikoko piece and I wrote yesterday

[https://stephenagwaibor.substack.com/p/trouble] that some of your predictions from then have manifested now. Here are a couple of paragraphs from the article which I'd reshare here:

"If you look at Meffy's policies purely from an economic lens, you'll scratch your head to see how it makes sense. Between October and now the CBN has gone into overdrive trying to do many things all at once which begs the question of why? Why are you launching new notes this close to the elections? Even if we were to ignore that, why's there a rush to get these old notes out so quickly? Why's the CBN introducing debit cards?

"It's easy to forget, but this is the second time Meffy's launched new notes. He came to office under former President Goodluck Jonathan in March 2014. This came about following GEJ's dismissal of his predecessor, Sanusi Lamido Sanusi. Meffy must have observed how things went then and learned something. The most important lesson is that the CBN governor and his policies are subject to the whims of the President.

"In December 2014, Meffy launched new ₦100 notes commemorating Nigeria's centennial anniversary. Then, unlike now, it was a phased introduction which is the global standard. There was no rush to get the new ₦100 notes. The CBN only had to stop printing the old notes and gradually mop them out of circulation. So it begs the question, why didn't Meffy use a tried and tested template? The apparent answer is Buhari."

This might not be a popular take, but I sincerely believe that on the matter of the redesign, Meffy is acting largely as a stooge, following the bidding of the president. If you see all of this as political rather than economic policy then it makes sense and you'll see that the so-called explanations like tackling inflation and whatnot are smokescreens to deflect from what is in reality, a political feud within the ruling party.

In Buhari’s speech yesterday, he cleared a myth. The APC propaganda machinery led by the Oshiomoles and El-Rufais said that Meffy was the one pouring poison in Buhari’s ears. But the president confirmed that it was his directive — which makes sense. As military leader in 1984, he led a currency redesign and fired the guy who got in his way. I opine that while Meffy is inept as a CBN governor, he's perfectly executed his role here as a stooge, a yes man. Had Meffy refused, he would simply have been booted out and a replacement who would do Buhari’s bidding would take his place.

This isn't a defense of Meffy. He's a very unpopular guy at the moment. But let's think critically here. Look at the Ways and Means advance for example. The CBN act of 2007 dictates that the CBN can only fund a budget deficit for a fiscal year no more than 5% of projected revenue. And when it does, it must not do so again until the FG clears the debt. Yet, by some accounts, the CBN funded the FG as high as 80% and did so recurrently! No CBN governor worth his salt should do that.

If you visit the CBN's website, [https://www.cbn.gov.ng/FAQS/FAQ.asp?Category=Monetary+Policy] its FAQ issues a cop out regarding the implementation of its monetary policy, particularly with regards to the Ways and Means advance. Let me share it, word for word:

"Can the Federal Government frustrate the Central Bank from pursuing its monetary policy?"

"Yes, when the Federal government exceeds its revenue the CBN finance government deficit through Ways and Means Advances subject (in some cases) to the limits set existing regulations, which are sometimes disregarded by the Federal Government.

"The direct consequence of Central Banks financing of deficits are distortions or surges in monetary base leading to adverse effect on domestic prices and exchange rates i.e macroeconomic instability because of excess liquidity that has been injected into the economy."

Meffy more or less is saying "I know the rules, but eh, it ain't all my fault". I believe this also applies to the currency redesign.