The NBS Backtracks

The NBS backtracks but not completely

I wrote about Nigeria’s bungled CPI rebasing in April 2025. Today, I am writing about the corrections the NBS has made. I raise another big issue that is unresolved with big implications in January and February 2026.

In other news, my macro course is returning this February, in addition to a financial analyst programme. To register, see the programme information here for macro and here for finance.

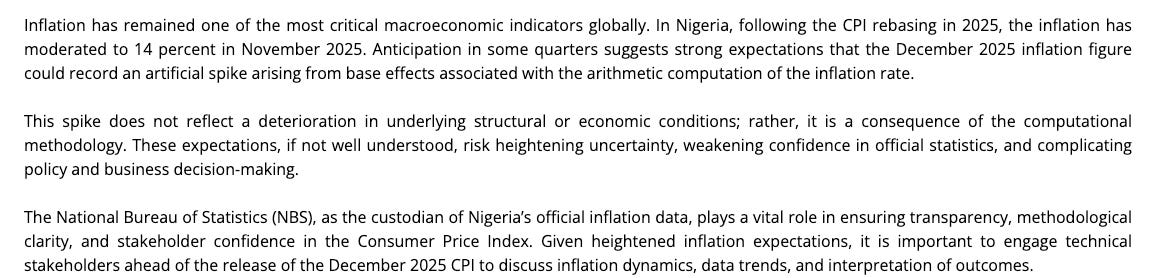

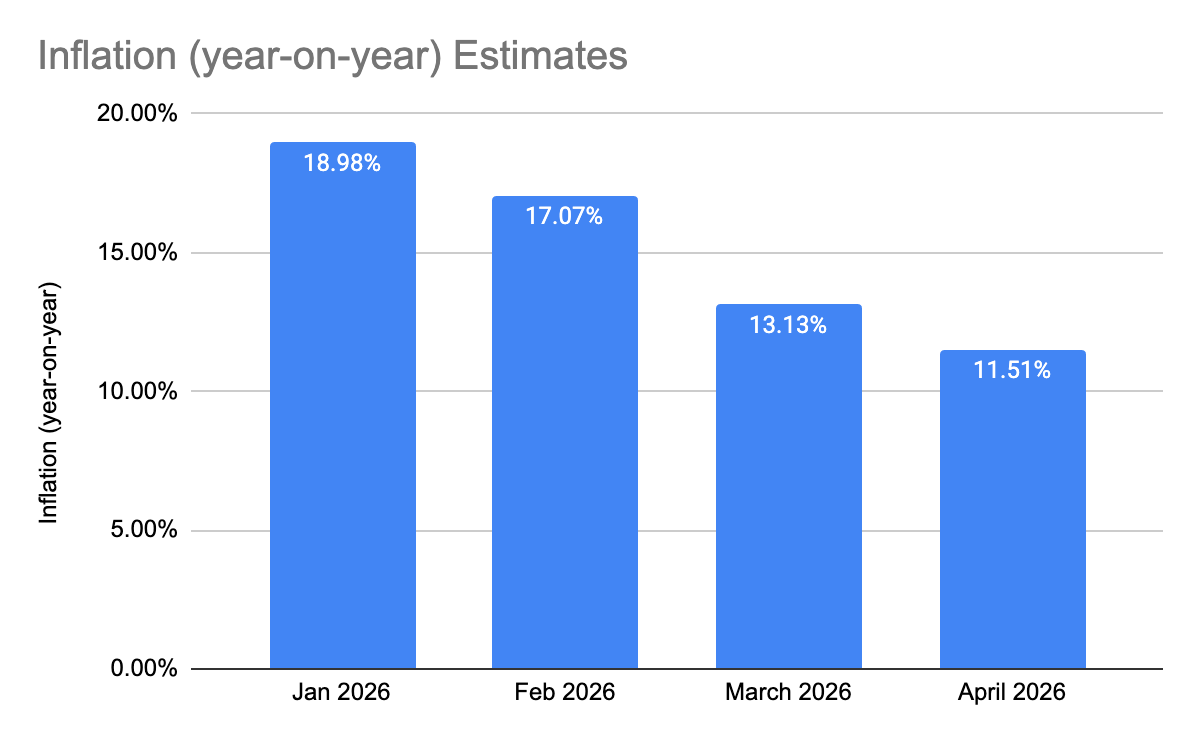

On January 12, the NBS hosted a workshop with the NESG to correct the mistake they made in the rebasing of Nigeria’s Consumer Price Index (CPI). Without this correction, December 2025 inflation would have increased to over 30% from 14.45% in November 2025.

The notice from the NESG is below:

On January 15, the NBS published revised CPI data to replace what they released during the rebasing.

In the revised CPI data, year-on-year inflation was 15.15% in December 2025 from 17.33% in November 2025. They managed to avert the disaster of reporting a 30%+ inflation rate.

The NBS restated the CPI to align with the ideal CPI I published when I wrote “The (NBS’) Point of No Return” in April 2025.

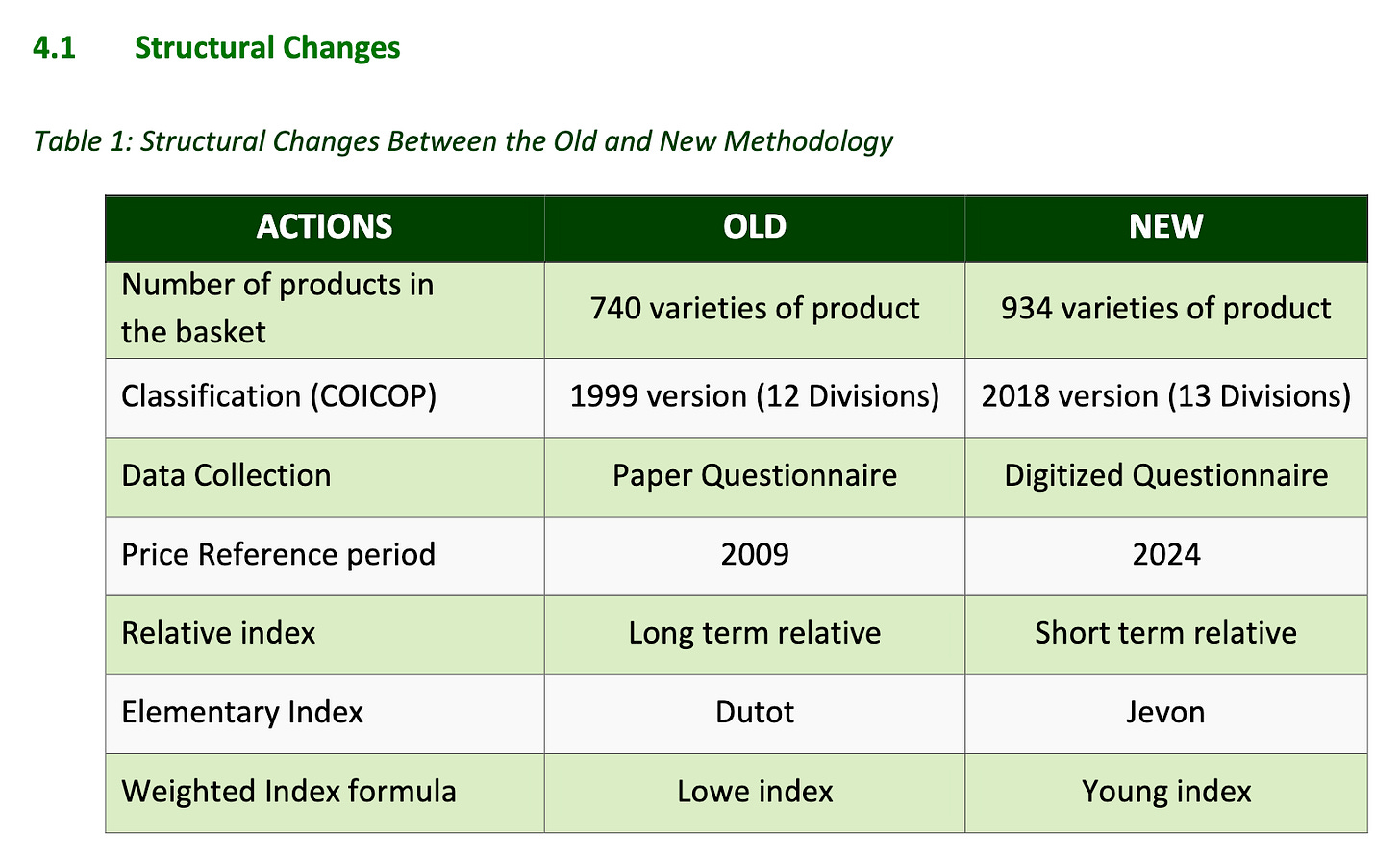

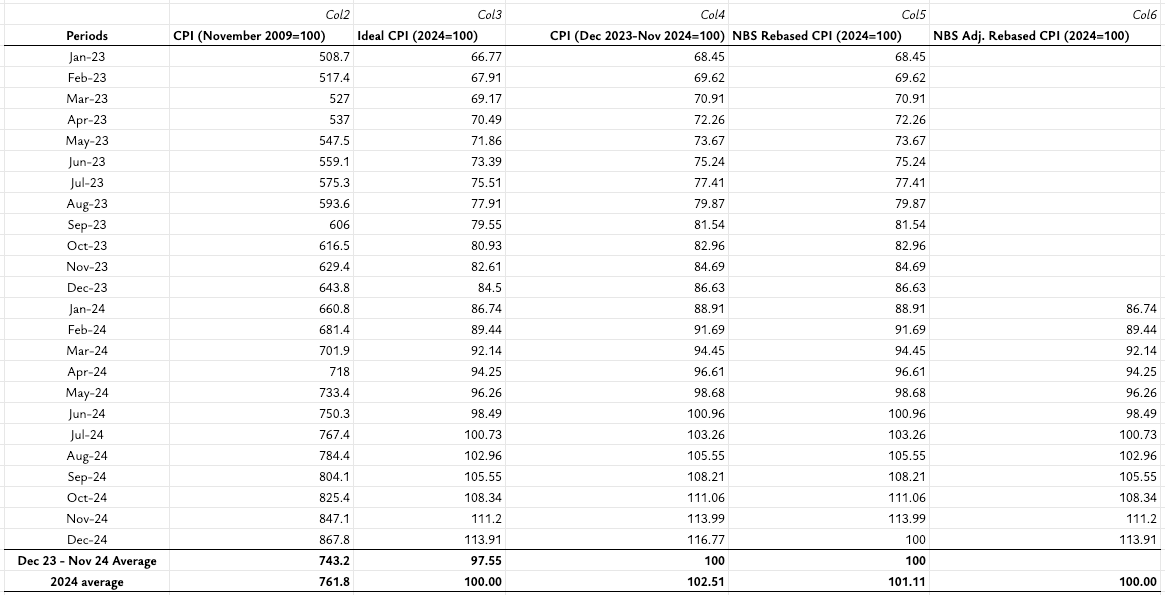

The table I shared then is posted below. Col5 was what the NBS initially released. This was wrong because of two things. First, you can see it aligns with Col4 except for the final month. The problem is that the NBS reported 2024=100 (which should be January to December 2024) as the base period but what they actually did was Dec 2023-Nov 2024. They lied but the worst thing they did was not following through. They manipulated December 2024 by making it 100.

The ideal CPI in Col3 is now what they have reported, which you can see in Col6. It took them a year to fix this basic error.

In my essay, I called out the inconsistency in the rebased CPI data. It did not make sense that they lied about the base period but also manipulated it. Someone in the NBS pulled a 100 out of their ass and included it in the CPI. That is what you see in Col5 in the table above.

The implication is that 2025 inflation numbers were understated on average by 3.04%. The average inflation rate they reported up till November 2025 was 21.03%, compared to the actual average of 24.07% in the new CPI series published.

I am always surprised at how easy it is to get away with nonsense in this country. I was shocked that the CPI rebasing was botched and it was accepted as normal.

The NBS manipulated the rebasing to reduce inflation which reached a pre-rebasing peak of 34.8% in December 2024.

The CPI is one of the easiest macro data you can produce. There is nothing complex about it. Yet the NBS sat on an error that was very basic for a year.

I am not one for conspiracy theories, but given the amount of effort the NBS put into doing the wrong thing, I am convinced they did this because it led to low inflation numbers. The alternative theory would be dangerous: the NBS is incompetent at basic arithmetic.

When it appeared that this would have consequences of very high inflation in December 2025, they decided to backtrack. Someone needs to tell the NBS that their duty is not to report low inflation numbers.

While the NBS has revised the CPI data, there is still an issue that will catch up to them in January and February 2026.

In the new CPI series, what you see between December 2024 and January 2025 is a decline in month-on-month inflation to -2.8%. How did the NBS go from saying month-on-month inflation jumped to 10.7% to now saying it fell to -2.8%?

This makes no sense and it is hard to verify. I suspected that the NBS had to raise month-on-month inflation in January 2025 because not doing so would have dropped inflation too low. The problem is that the index number derived from this process is still maintained in the new series of CPI.

The chance of a negative month-on-month reading in inflation between December and January is 10%, per prior data of almost 30 years. The chance of such a sharp negative month-on-month reading is 0%. The chance of such a reading bucking against the trend is 0%.

The momentum in price increases was so strong that an isolated negative reading is suspicious. Whether you defer to history or to 2024 trend, you will arrive at this conclusion. I am not saying it is impossible for this to occur, it is just improbable.

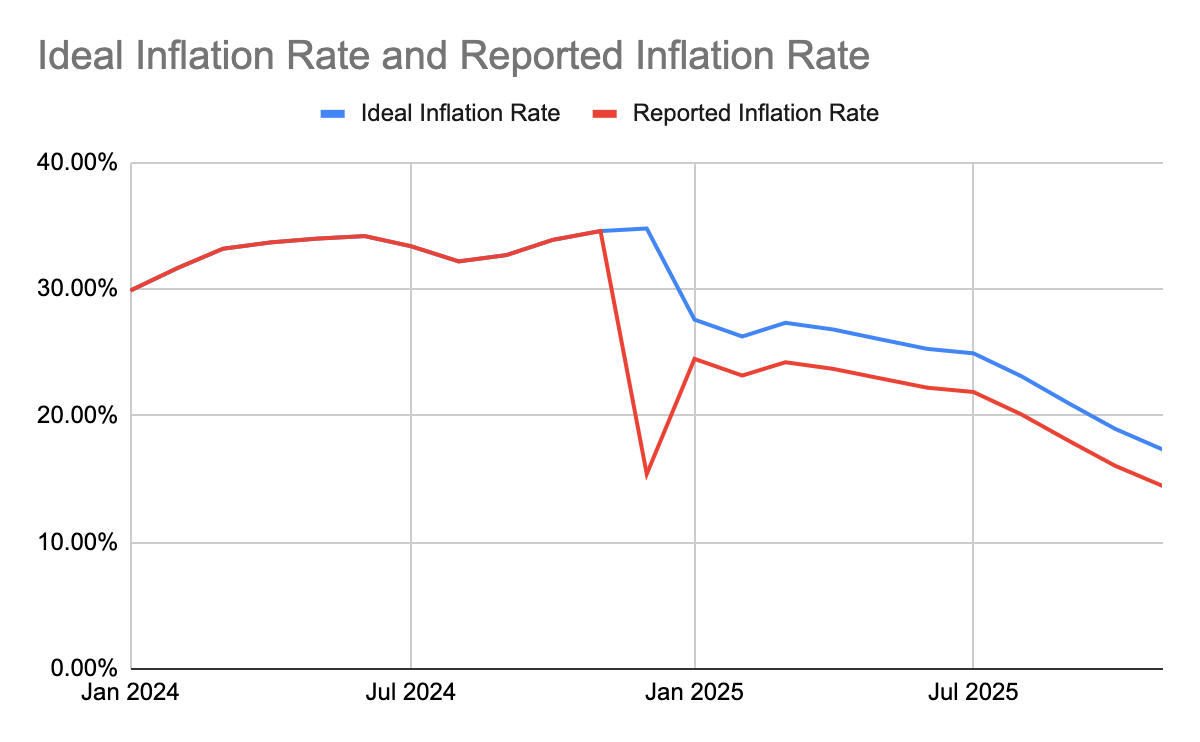

Below, I have updated the earlier chart to include “Inflation Trajectory”. I assumed that the month-on-month inflation is a conservative 2.0% in January 2025, and look at the difference it makes. On the surface, it is even a more believable chart.

By my calculations, inflation should have averaged 30.24% in 2025. This implies a massive understatement of 9.21% on average compared to the 3.04% understatement I calculated with the revised CPI data.

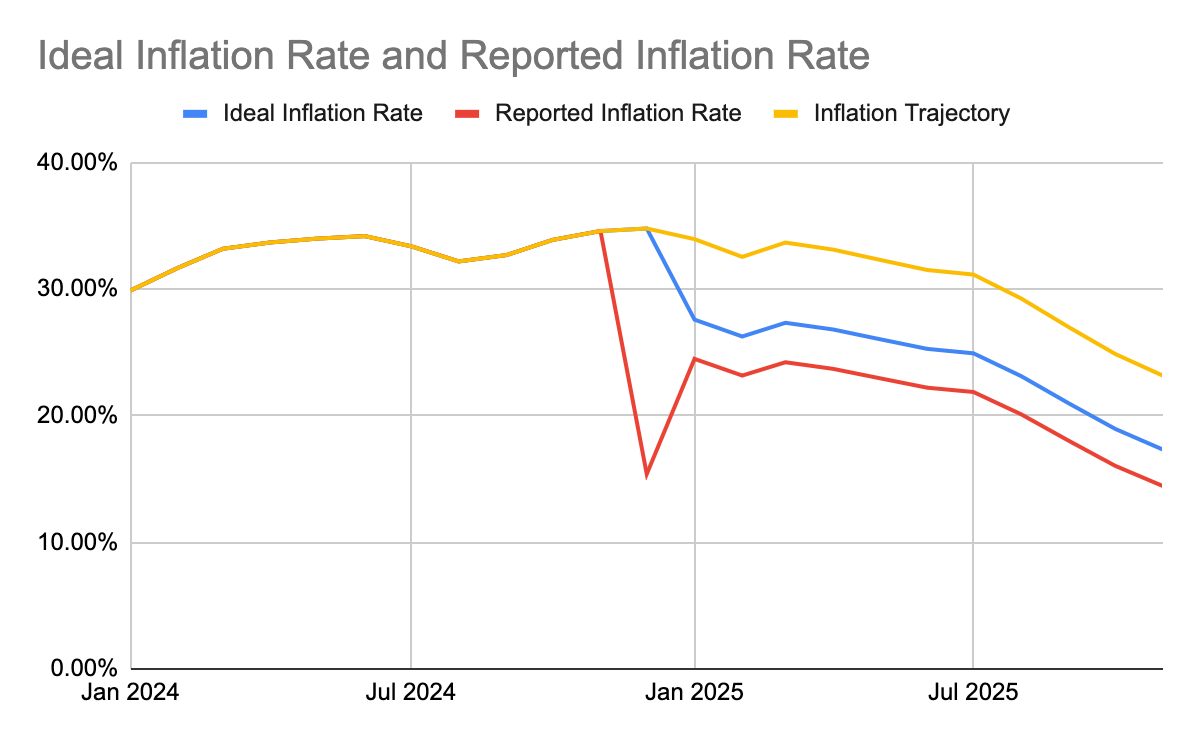

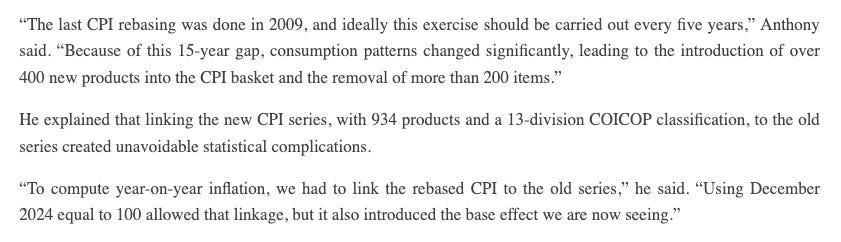

The problem the NBS has now is that year-on-year inflation in January 2026 will spike to 19%+ because of the unusually low base manufactured in January 2025.

As you can see in the chart below, this will be followed by still high inflation in February 2026 until it normalises in March 2026. To derive my estimate, I assumed only a conservative 0.4% month-on-month inflation in each of the four months.

Clearly, this claim by the Director of Price Statistics at the NBS is incorrect.

I called out the lies of the Director of Communications at the NBS in April 2025.

Sadly, the same is being repeated in January 2026. They keep lying about what they have done, making it seem as a routine exercise. The long delays before rebasing will not cause what has happened.

Congratulations to everyone involved in this clusterfuck.

On a final note, inflation is bound to be structurally lower going forward because of some changes to methodology. The change from Dutot to Jevon elementary index ensures that extreme price changes are contained due to the substitution effect.